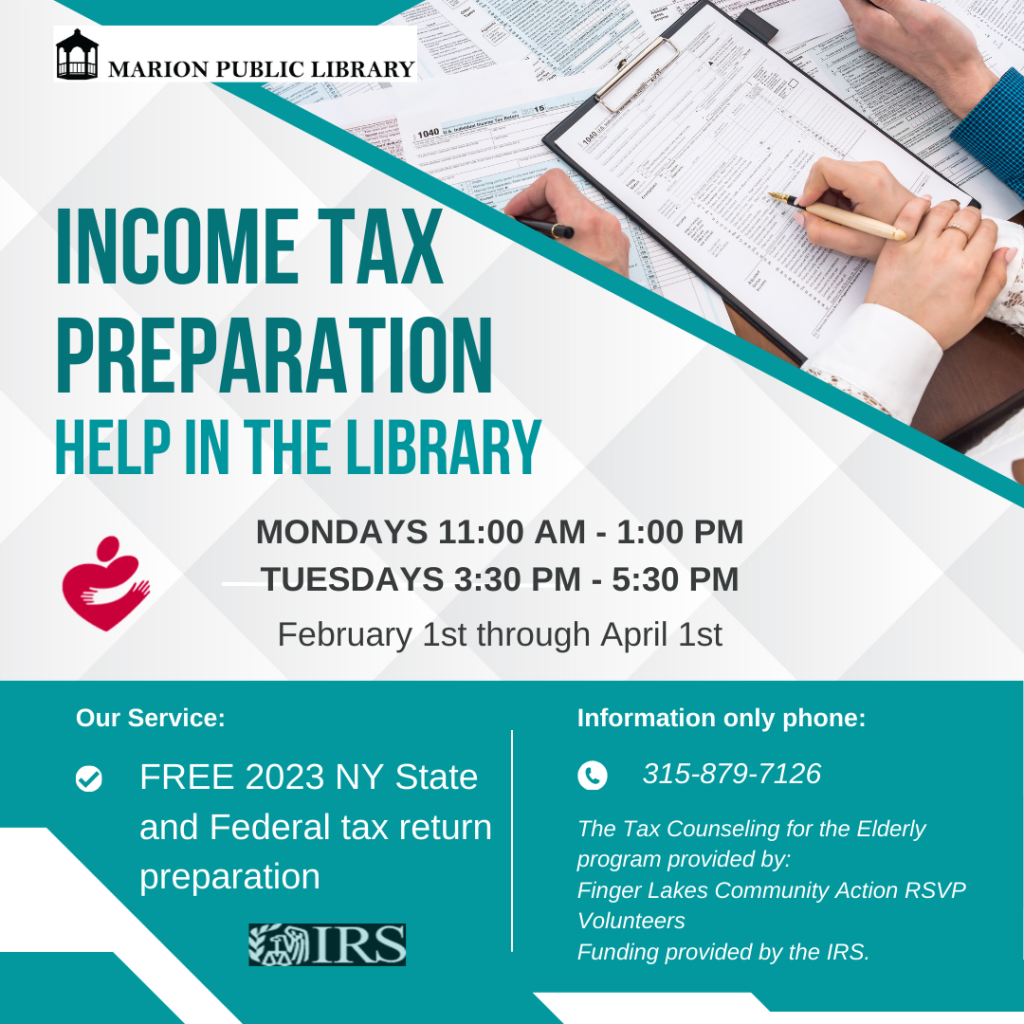

Income tax preparation help will be available February 1 – April 1.

Mondays 11 AM – 1 PM

Tuesdays 3:30 – 5:30 PM

Pick up a packet in the Marion Library. This program is not only for the elderly.

What do I need to bring with me to my DROP-OFF?

• A copy of your 2021 and 2022 tax returns

• Taxpayer’s Proof of Identity for all individuals on the tax return

o Driver’s License or other government issued photo ID.

• All forms, W-2, 1098, 1099 and 1095A, 1099-G (Unemployment) and 1099-SSA (Social Security)

• Information for other income

• Identification number for Childcare Provider

• Information for deductions/credits

• Proof of account for direct deposit of refund (e.g., voided check)

• Social Security Cards and/or ITIN notices/cards for you, your spouse, and dependents

• PROOF/DOCUMENTATION REQUIRED IF:

o THEY HAVE CHILDREN did they receive Advanced Child Tax Credit; Letter 6419.

o THEY RECEIVED EDUCATION CREDITS they need 1098-T Tuition Statement.

o THEY PAID Student Loan Interest.

o THEY MADE Charitable Donations.

o THEY PAID property tax.

CALL: 315-879-7126 THIS IS AN INFORMATION ONLY PHONE NUMBER

The Tax Counseling for the Elderly program provided by: Finger Lakes Community Action RSVP Volunteers. Funding provided by the IRS.